L2 Planet Issue #25

In this Issue of L2 Planet, we focused on the developments regarding Aztec, Momoka, Optimism, Arbitrum and StarkNet Ecosystem.

Aztec Hybrid Rollup

Aztec announced its new hybrid Rollup design after sunsetting zk.money. So, what is a hybrid Rollup? How does it work?

Is it a zkEVM? No, it is a zero-knowledge execution environment using Noir. Aztec’s hybrid Rollup design enables both public and private execution of smart contract logic. This means there are public and private state environments and they are fully composable. For example, a public function can call a private function or vice versa. Also, private functions can call private functions and that means smart contracts whose logic is invisible to blockchain observers can call other contracts with invisible logic.

Simultaneously, Aztec no longer executes transactions like a conventional blockchain, instead proving the correctness of transactions that have already been computed. In Aztec’s prior Connect design, UTXOs represent the value of a token. Now, it presents any data you like. In other words, UTXOs now store entire smart contracts. What about Account Abstraction? Aztec account abstraction facilitated by Noir circuits will support:

Smart contract wallets

M of N multisigs

Schnorr Signatures

ECDSA over the 25519 curve (the same signature scheme as Apple’s TouchID)

Social recovery

The main reason for hybrid design is public account-based blockchains like Ethereum can’t support native privacy and UTXO-based privacy solution can’t support applications and tools that have been created for public smart contract platforms.

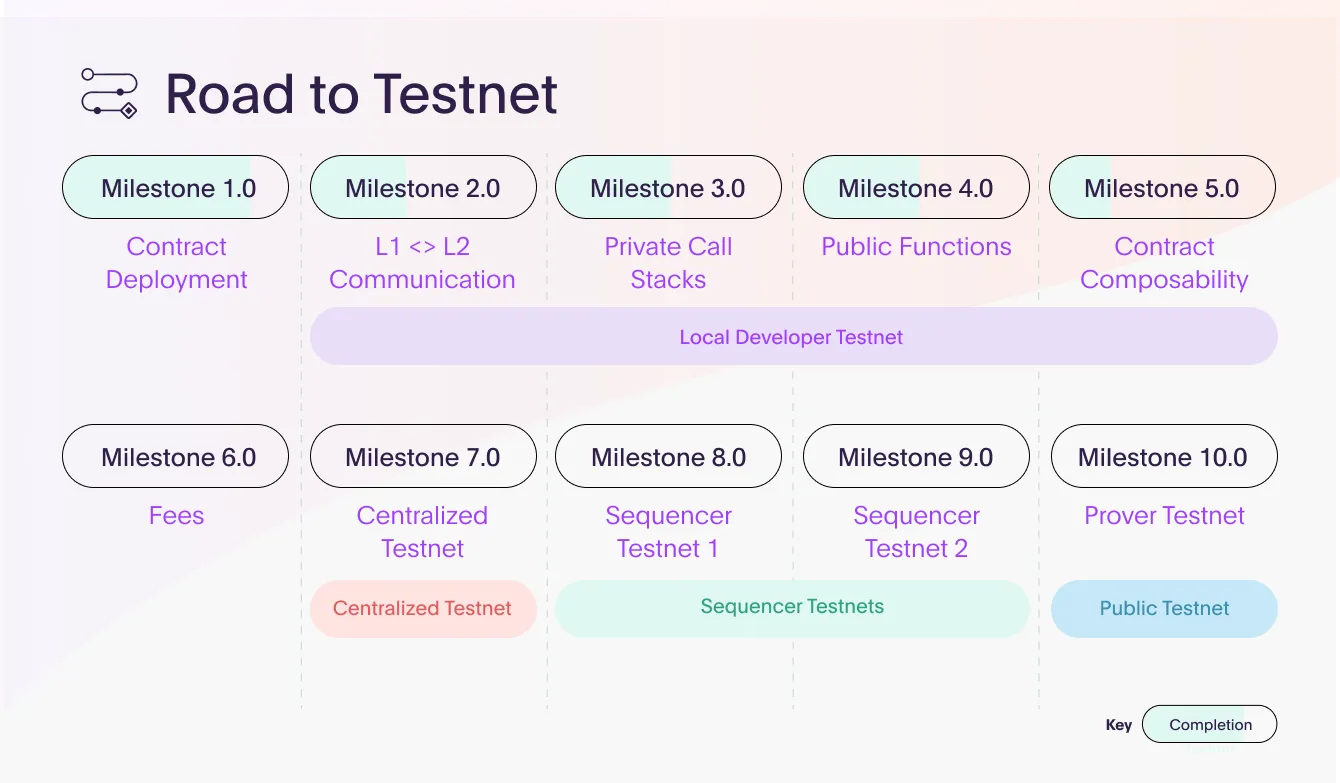

Aztec targeting 100+ TPS and single-digit cent transactions by mainnet launch. Mainnet, wen? According to the new roadmap, Aztec is on the way to completing basic contract deployment (Milestone 1.0) and expecting local dev testnet in Q3 2023. You can see the full roadmap image below.

Also, Aztec needs help with the Decentralized Sequencer Selection design. You can find this request here. One more thing, do you know that Aztec is the fastest-growing developer ecosystem in Q1 2023 according to Electric Capital's developer report?

Momoka Optimistic L3

Lens Protocol introduced Momoka, an Optimistic Layer-3 solution. So how does Momoka work and what problem does it aim to solve? Let's look at the details of Momoka.

For Lens Protocol, the block space provided by Polygon's 2-second block generation rate is not enough. When we consider that social networks with high transaction frequency can see 25k transactions per second, it is understandable that Polygon PoS is insufficient. So, the Lens engineering team built Momoka.

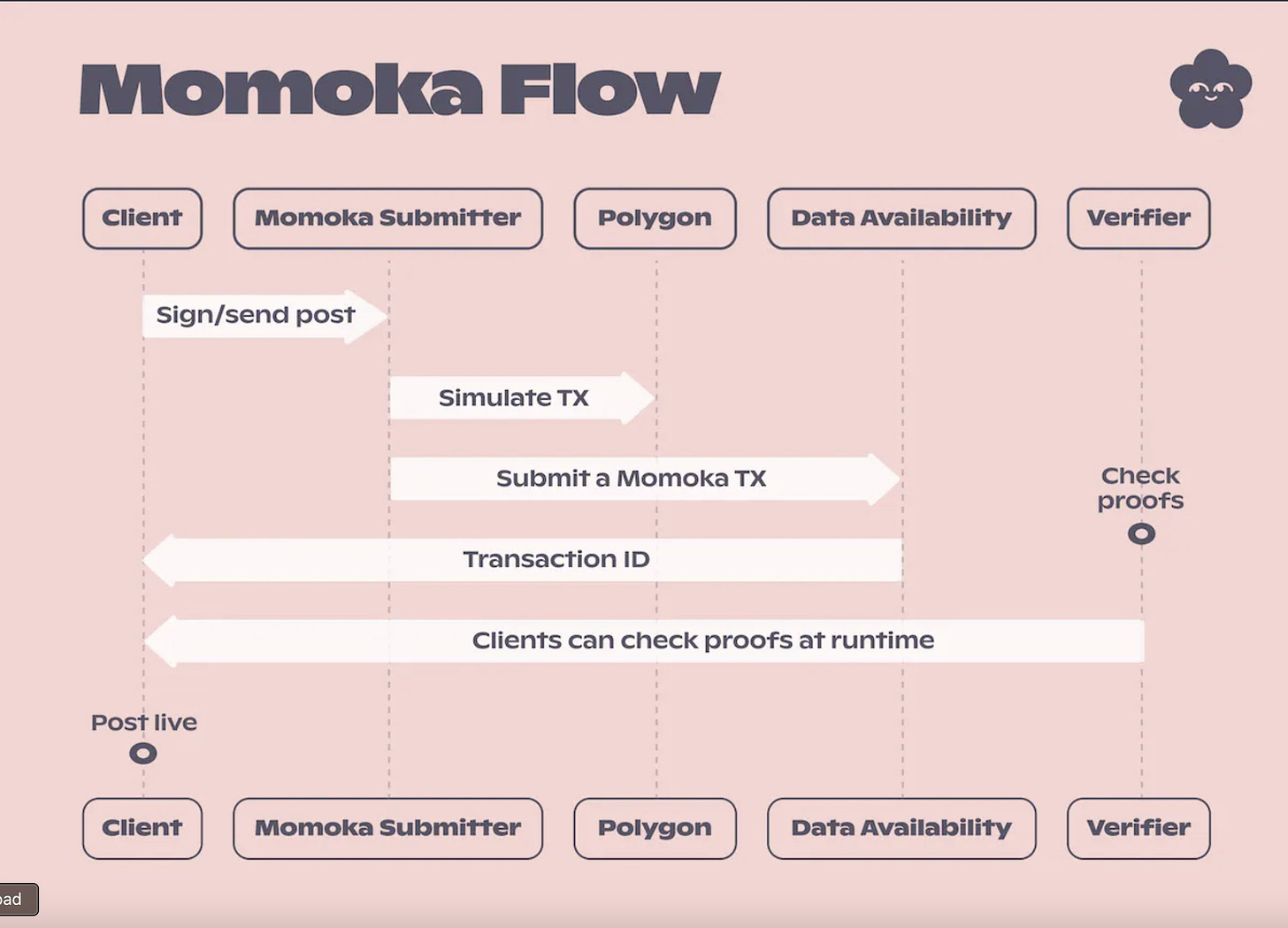

Momoka simulates transactions that would normally take place in Polygon, calculating off-chain state transitions and sending relevant data to decentralized storage solutions. Unlike the Layer-2 solutions we are used to, Momoka does not compress transactions. Actors called Submitter sends transaction data to ArweaveEco via Bundlr Network and actors called Verifiers checks the validity of this data. Calculating transactions off-chain by simulating and publishing only state transitions significantly reduces transaction costs while scalability and efficiency increase.

The current system brings some questions to mind. For example, if being a Submitter or Verifier has no crypto-economic benefits, why would we want to run this software? Is crypto-economic return essential for decentralized social media? Currently, the only Submitter software is run by Lens Protocol, but a system where anyone can become a Submitter is envisioned in the future. Being a Verifier is permissionless. Anyone can run an archive node to object to a faulty or non-Lens contract state transition.

The team reported that Momoka was beta tested in Lenster, Lenstube, orb, Buttrfly, and Phaver. It is also stated that in the future, the validity of transactions can be based on a consensus, and incentive and punishment mechanisms can be added. So, wen token?

Optimism Bedrock on the Way

Bedrock is the name of the first official release of the OP Stack, a set of free and open-source modular components that power Optimism. Bedrock brings several improvements over its predecessor and is designed to be modular, upgradeable, and as close to 100% Ethereum-equivalent as possible. Some of the key improvements and features of the Bedrock release are:

1. Lower fees: Bedrock implements optimized batch compression and removes gas costs associated with EVM execution when submitting data to L1, resulting in reduced transaction fees.

2. Shorter deposit times: Bedrock introduces support for L1 re-orgs in the node software, which significantly reduces the time required to confirm deposits from up to 10 minutes to within 3 minutes.

3. Improved proof modularity: Bedrock abstracts the proof system from the OP Stack, allowing rollups to use fault proofs or validity proofs (like zk-SNARKs) to prove the correct execution of inputs on the rollup. This enables the use of systems like Cannon to detect faults in the system.

4. Improved node performance: Bedrock allows the execution of multiple transactions in a single rollup "block," reducing state growth and improving node performance. Technical debt from the previous version is also removed, improving efficiency in querying transaction data from L1.

5. Improved Ethereum equivalence: Bedrock aims to be as close to Ethereum as possible, removing deviations from Ethereum found in the previous version of the protocol. It adds support for EIP-1559, chain re-orgs, and other Ethereum features present on L1.

The protocol specifications of Bedrock provide details on various components, such as deposits, withdrawals, batches, block derivation, and fault proofs. The protocol is designed to guarantee the timing of deposits, handle L1 and L2 timestamps, and ensure the correct ordering of transactions on the L2 chain. The Bedrock release also introduces a two-step withdrawal process to enhance security.

Overall, Bedrock enhances the performance, scalability, and compatibility of the OP Stack, making it a powerful solution for building on Optimism Mainnet. Developers can refer to the documentation and contribution guidelines to understand how to develop and contribute to the OP Stack.

Action Plan:

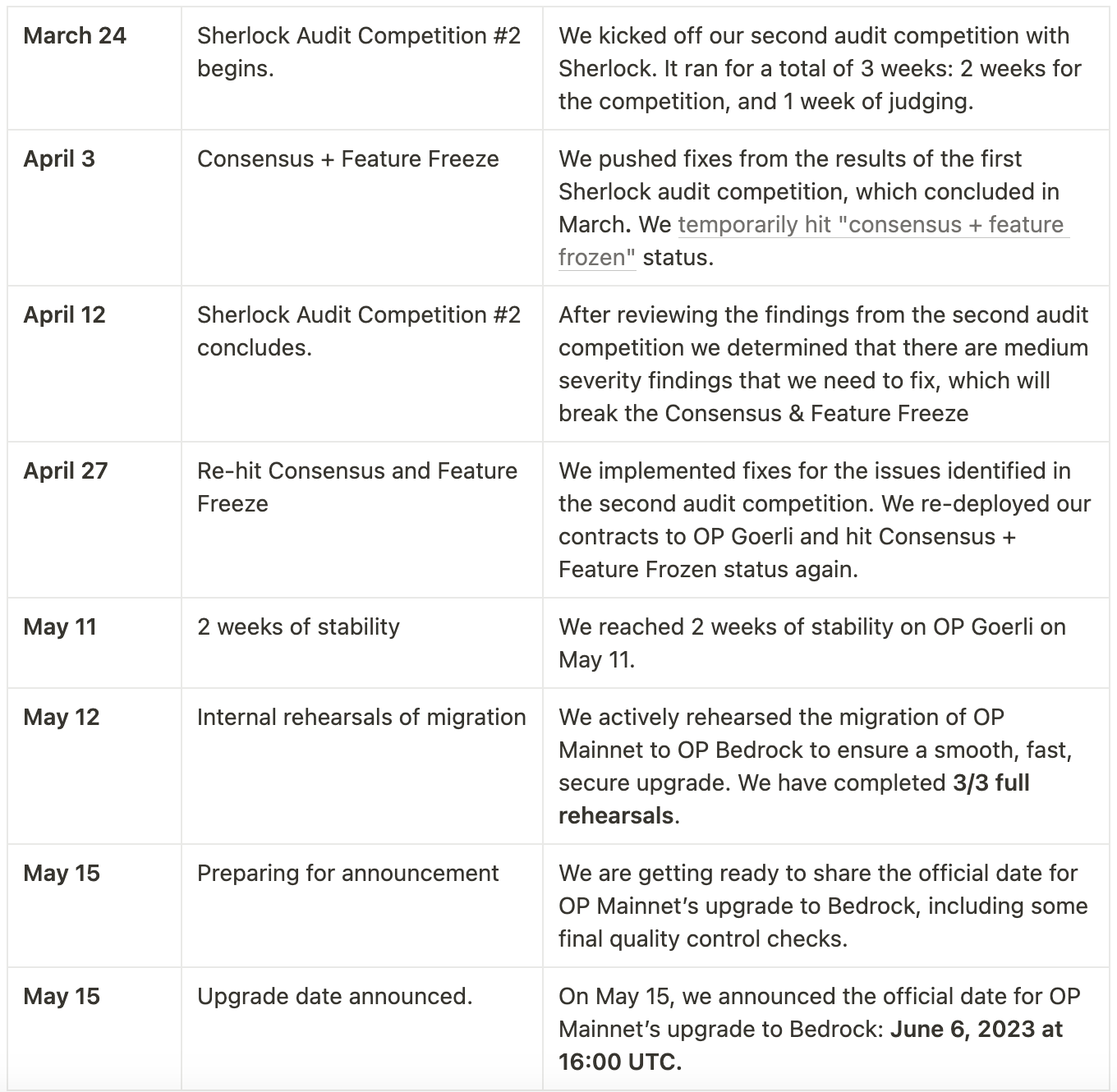

As most of you know Bedrock has already launched on Goerli Testnet and Upgrade proposal for Bedrock has been approved by TokenHouse, so for now we are waiting for the results of some tests:

Mainnet Upgrade Timing:

Go-live criteria will be used instead of specifying an exact date for the upgrade.

Criteria include a successful upgrade of Goerli to the "Regolith" release, a follow-up audit, and 2 weeks of testnet stability.

A public announcement will be made with 3 weeks' notice to the community.

Contingency Plans for Bugs or Issues:

Rigorous go-live criteria help ensure ideal conditions for the upgrade.

If last-minute bugs or issues are found, necessary fixes will be made before proceeding.

Low-severity bug fixes and small-scope refactors will not be considered "un-freezing."

Communication and Education to the Community:

Optimism Foundation and OP Labs will handle communication efforts.

Public communications and tweets will be used to inform stakeholders about the upgrade.

Reminders will be sent in the weeks, days, and hours leading up to the upgrade.

Note: The Regolith hard fork will be activated on Optimism Goerli before the governance vote completes, and Optimism Mainnet will be upgraded to Bedrock with the activated fork.

As ordinary users, you do not need to take any action for the upgrade. However, during the launch of Bedrock, the network will be temporarily shut down for a period of 2-4 hours. The official date of OP Mainnet’s upgrade to Bedrock has been set: June 6, 2023, at 16:00 UTC! Stay optimistic!

Arbitrum Ecosystem

An interesting proposal took place in Arbitrum Forum, Distribution of DAO Revenue to ARB Token Holders. What it is meaning?

When we send a transaction on Arbitrum, there are two types of fees we pay:

L1 fee to pay for costs on Ethereum.

L2 fee to pay for costs on Arbitrum.

L1 fees are paid by Sequencer in order to cover the cost of posting the transaction’s data onto Ethereum. Thanks to EIP-4844, that cost will significantly reduce with the new blob transaction type. EIP-4844 is still in progress and we will not cover it in this issue. If you want to learn more check out our issue #10. Another fee is the L2 fee which we pay to Sequencer in two portions, a min base fee and a surplus fee that is anything above the min base fee. Both fees generate revenue for Sequencer and accumulate in separate smart contracts. Arbitrum planning to trigger these contracts and share Seqeuencer’s revenue with Arbitrum DAO.

According to the proposal, PSY suggests distributing DAO revenue to ARB token holders. The proposal is giving a utility to ARB tokens beyond the “worthless governance token”. Fyi, there are ~3,352 ETH in total revenue that comes from base and surplus fees. What do you think, should they do that?

What else happened in the last two weeks in the Arbitrum ecosystem?

AltLayer was announced as the first Rollups-as-a-Service provider to support Arbitrum Orbit.

Nitro v2.0.14, which includes offline pruning & eth_sendRawTransactionConditional (not yet enabled on mainnet) and fixes miscellaneous validator issues, has been released.

Prohibition which is an open, community-driven & on-chain generative art platform, deployed on Arbitrum.

Prime Protocol, the first-ever cross-chain liquidity protocol that allows users to easily manage assets and positions across multiple chains, is live on Arbitrum.

Scalene, a 3D NFT marketplace, is live on Arbitrum.

Vertex Protocol, a hybrid Orderbook-AMM DEX, is live on Arbitrum.

Starknet Ecosystem

Everai and The Ark Project joined forces to build a Starknet NFT Bridge, Starklane.

According to the proposal, the Starklane NFT bridge is a public good that aims to provide a seamless, secure, and efficient solution for transferring every type of NFT tokens between Ethereum Layer 1 (L1) and StarkNet Layer 2 (L2). By building Starklane, users be able to transfer ERC-721 and ERC-1155 tokens between L1 and Starknet. There are four scenarios in the case of bridging NFTs:

Bridging L1 NFTs to L2

Returning L1 NFTs from L2

Bridging L2 NFTs to L1

Returning L2 NFTs to L1

The proposal also includes verification solutions for NFT smart contract ownership, technical overview, strategy, benefits, potential issues, etc. You can find the full proposal here.

What else happened in the last two weeks in the Starknet ecosystem?

zkLend, an L2 money-market protocol, launches its alpha Mainnet.

Starksport, a DeFi and NFT market, live on Starknet Mainnet.

Starknet Early Adopter Grants Decisions have been announced.

Starknet and its native Account Abstraction are now fully available on Alchemy.

Expectium Protocol, an information market, is live on testnet.

ETHPrivacy Event

ETH Privacy event held place in Istanbul on April 30. Four teams of hackers worked 48 hours to win the hackathon. Here is the list of local university clubs who win a prize:

Note: Twitter Corner is not available in this issue due to Twitter API restrictions.

Spectating Corner

Reading Corner

What are Storage Proofs and how can they improve Oracles?, Starkware

Shared Sequencing: Defragmenting the L2 Rollup Ecosystem, Espresso Systems

The State of ZK 2023 Q1, zkValidator

What is A zkEVM?, Linea

That’s all from L2 Planet for now, hope to see you in 15 days :)