L2 Planet Learn: Journey to L2 DAOs

In this series of L2 Planet, we will examine the structure of DAOs and the DAOs on L2 solutions.

What is a DAO?

DAO is an acronym for the phrase decentralized autonomous organization. DAO carries the meanings of the three words that make up its name.

Main features of DAOs

1. Clear structure and roadmap —The vision of the organization is determined by the members, the members have full control and decide the future of the DAO.

2. Voting — Interested sides can participate in important decisions on their own. Imagine voting for a presidential candidate over the phone.

3. Set of rules — Automated crowdsourced decision making eliminates human error, manipulation and third parties. The DAO organization is represented by transparent calculated rules.

4. Open source code — Pinned on a digital ledger over the internet, counterfeit-proofed by a blockchain, and distributed as a distributed database.

5. A fund token — Owning a token is what determines your voting power. If we have briefly understood DAOs, let's now examine a few DAOs on L2s.

PLUTUS DAO

Plutus DAO is an aggregator that aims to gather governance power in the DOPEX/JONES ecosystem through the coins plutus, veDPX, and veJONES, which aim to provide maximum liquidity and rewards to its users on Arbitrum.

Jones iAsset liquidity providers can earn Jones rewards through Plutus without the need to lock veJONES.

PlsASSET is a 1:1 tokenized veASSET that is minted and locked in Plutus forever. This governance power is controlled by the PLS token.

PLS Mechanics

PLS is the local government token of Plutus.

PLS can be locked in Plutus to earn some of the platform fees and revenue generated by its Productive Treasury.

Locked PLS receives platform fees and Productive Treasury yield as plsJONES & plsDPX to increase the amount of veBoost and governance power controlled by locked PLS offered by Plutus.

Locked PLS provides control over veJONES and veDPX locked within Plutus.

DOLLAR MAXI CASES

Dollar maxi cases are built on top of Dopex and Jones J-asset with the goal of achieving high yields at the expense of an increased chance of permanent loss. Strategies for each private safe will be clearly communicated and displayed on the deposit page before the deposit. Plutus will build on top of Jones ETH strategy, let’s look at the example strategy.

Users will deposit ETH to the vault, 40% of ETH will be deposited in the Jones ETH Strategy Vault and jETH will be minted in return.

40% of ETH will be compared to jETH and invested in Jones jETH LP farm, 10% of ETH is transferred to DPX, 10% of ETH is matched to DPX and invested in Dopex DPX-ETH LP Farm.

Plutus DAO Token Economy

Maximum Supply: 100 Million

%35-Platform Awards

Plutus LP Farms Incentives awarded proportionally for JONES received in Plutus

%15 - Liquidity mining

Single stake plsAssets + PLS-ETH LP incentives + plsAsset LP incentives.

%13.8-Operational Allocation

Community focused activities, future incentives, promoting external contribution, DAO swaps etc.

%10- Bonding

The bond funds will be used to acquire assets deemed important to the Plutus ecosystem.

%10-Public Tour

Funds will go to develop a productive treasury

Dopex LPs, Jones LPs, jAsset LPs, DPX, etc.

%4.2-Private Tour

All funds in the private round will go towards the long-term development of Plutus.

Special round funds have a 3 month cliff and 3 months vesting

%12-Plutus Team

80% — 3 month cliff, 18 months vesting

20% — Shares in liquidity pools.

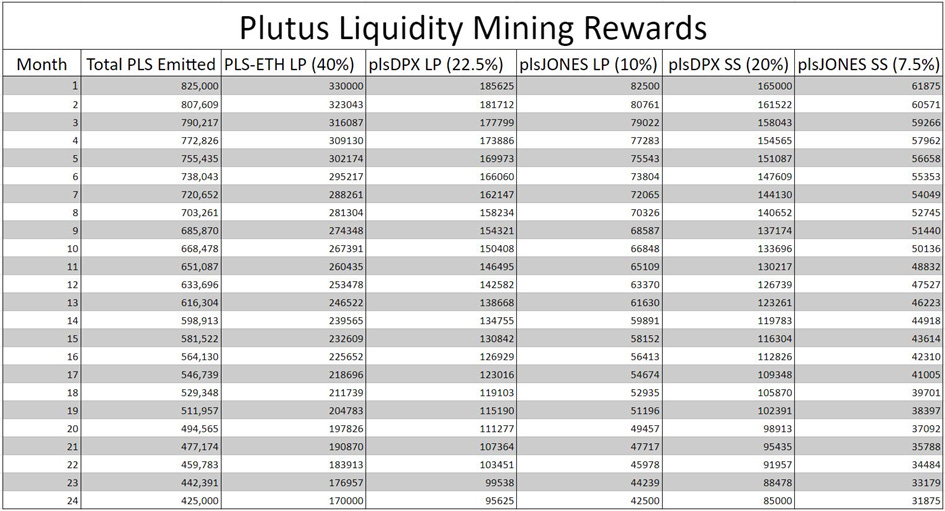

Liquidity Mining emissions

Current statistics of PLS

PLS rewards claimed over time

Ratio of last 6 Months locked PLS and units in circulation relative to locked assets

L2 DAO

L2DAO is basically a project that started to fill the gap in L2s adoption.

L2DAO tries to grow the L2 ecosystem and invests in projects. It uses its DAO treasury to invest in L2 protocols and ecosystem games. It provides a diversified venture fund service to investors who want the L2 ecosystem to grow. It also provides liquidity, deposit and staking services continuously transferring revenues back to the DAO. It specifically supports protocols that have not issued their own tokens. L2DAO is managed by token holders. The bidding and decision-making process is decided by the token holders and actions proceed as a result.

L2DAO future goals;

To be the largest investing DAO of the largest and most promising L2 projects.

To raise awareness about the L2 ecosystem.

Participating in projects with grants and other methods

To support business partners on their way to becoming a leader through promotion, liquidity and financial support.

L2DAO has a name service such as Ethereum Name Service (ENS) that allows you to get L2 domain addresses. It also frequently distributes NFT airdrops to L2 users. Being included in the L2DAO ecosystem and making decisions together with the DAO is done through token ownership.

L2DAO Token Economy

Network: Arbitrum, Optimism

Maximum Supply: 1.0B

50% DAO Treasury

30% For early adopters of Airdrop Layer 2 protocols

10% $L2DAO liquidity incentive

10% Core Team

Let's take a look at a few statistics pertaining to the token.

Treasure DAO

TreasureDAO is a decentralized NFT ecosystem built on Arbitrum specifically for metaverse projects.

Treasure's native token, $MAGIC, is the only currency for marketplace transactions. In this way, $MAGIC acts as a backup currency for the entire interconnected metaverse network under the Treasure umbrella. Treasury projects are connected narratively and economically through $MAGIC. The DAO uses $MAGIC emissions to grow new projects and continue to support more mature projects. Over time, Treasure hopes to be a pioneer of decentralization across the entire NFT ecosystem. The DAO will begin to build decentralized competitors to existing NFT products. It will use the proceeds from this to quickly launch new projects and continue growing older ones. $MAGIC will act as a volcano to increase decentralization in the metadatabase and develop decentralized crypto-economic primitives that can function as “real world” economic assets.

The team highly values and cares about $MAGIC. It has designed every part of its ecosystem accordingly. The most important way to participate in Treasure management is to own $MAGIC.

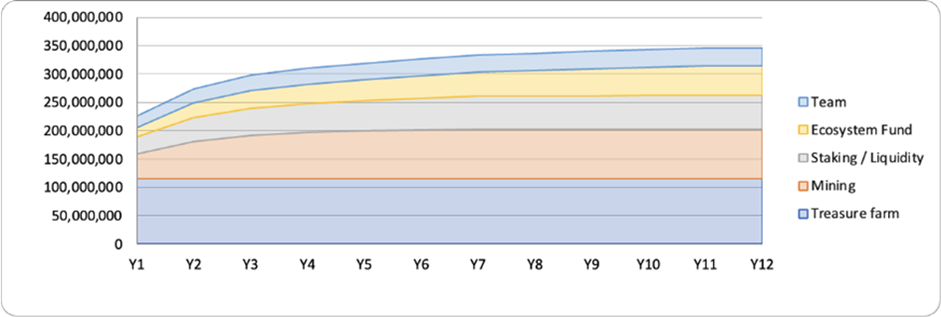

$MAGIC Token Economy

Maximum Supply: 350 M

33% Treasure Farm fair launch.

25% Mining

%17 Staking and liquidity for liquidity provision, protocol liquidity and staking rewards

%15 Ecosystem Fund (used to finance ecosystem growth as needed)

%10 founder and principal contributors (3 month cliff plus 2 month linear basis)

The $MAGIC emission mimics the Bitcoin halving, but this event happens every year, not every four years. It has high inflation, and the team states it was designed to create long-term sustainability.

We would like to thank the author of the article, @0xInvy, for his contributions. See you in the next ‘‘ journey to L2 DAOs issues’’ :)

You can support the L2 Planet newsletter and this content by donating to L2 Planet via Gitcoin :)